One of the knocks on Tripadvisor a decade ago was that it was too dependent on its two largest advertisers, Expedia and the Priceline Group.

Major online travel agencies like Expedia and Priceline Group, now called Booking Holdings, advertise their hotel rates in metasearch engines like Google Hotels, Tripadvisor and Trivago to attract bookings.

Before Google Hotels came along, offering its own hotel metasearch or price comparison feature, online travel agencies and some hotels considered advertising in Tripadvisor metasearch a “must-have.”

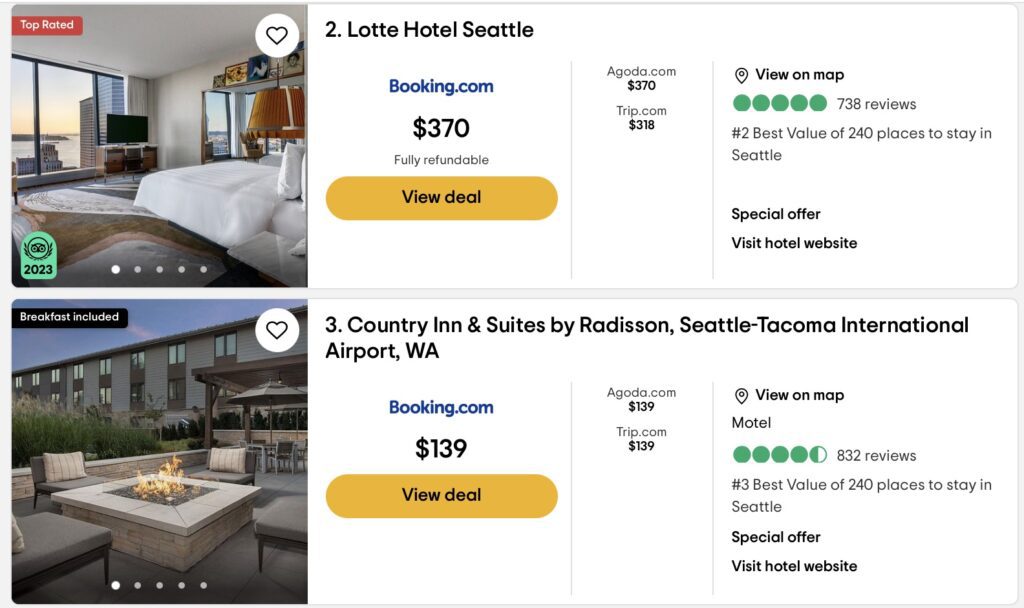

The image shows Booking.com, Agoda and Trip.com ads in Tripadvisor hotel metasearch on February 26, 2023. Source: Tripadvisor

Tripadvisor 2023 Versus Tripadvisor 2013

In 2013, advertisers Expedia and Priceline and their affiliated brands, such as Hotels.com and Booking.com, respectively, accounted for 47% of Tripadvisor’s revenue.

In 2023, Expedia Group and Booking Holdings, generated only 25% of Tripadvisor’s total revenue, according to a recent financial filing.

In 2022, the duo was responsible for 35% of Tripadvisor’s revenue so their participation dropped 10 percentage points in a single year.

More Viator, Less Metasearch

Tripadvisor’s reduced dependence on Expedia and Booking is mostly a good thing. The concern was always that if one or both decided to stop advertising in Tripadvisor’s hotel metasearch or price comparison service, then Tripadvisor would suffer.

That happened to Trivago in 2017. It was even more reliant on the two big online travel agencies than Tripadvisor. It made some site changes around that time that angered Booking Holdings executives and prompted them to reduce their advertising on Trivago – its revenue and profits nosedived.

Tripadvisor’s reduced dependence on Expedia and Booking Holdings advertising speak to the rising contribution of Viator, which Tripadvisor acquired in 2014 for $200 million.

Its dining reservations platform, TheFork, is also a factor, though to a lesser extent.

“The percentage of revenue concentration from partners is impacted by higher growth across non-hotel categories, particularly experiences and dining — as the non-hotel categories become a larger percent of total revenue, this concentration percentage is impacted,” a Tripadvisor spokesperson told Skift Monday.

In 2023, Viator and TheFork accounted for 41.2% and 8.6% of Tripadvisor’s total revenue, respectively. Backed by a marketing campaign, Viator’s 2023 revenue jumped 49% year-over-year, and it was the fastest-growing segment in Tripadvisor’s portfolio.

Tripadvisor’s formerly core business, hotel metasearch and business subscription services, has been declining as a percentage of total revenue for several years.

The Google Factor

As Tripadvisor noted in its recent annual report: “We believe our SEO traffic acquisition performance has been negatively impacted in the past, and may be impacted in the future, by metasearch and search engines (primarily Google) changing their search result placement and underlying algorithms, including to increase the prominence of their own products in search results across our business, most notably within our hotel meta offering within our Brand Tripadvisor segment.”

So Tripadvisor has diversified its revenue streams, and its hotel metasearch service, stung by Google, has been less of a must-have for major online travel agency advertisers.

Subscribe to Skift Pro to get unlimited access to stories like these

{{monthly_count}} of {{monthly_limit}} Free Stories Read

Subscribe NowAlready a member? Sign in here

Subscribe to Skift Pro to get unlimited access to stories like these

Your story count resets on {{monthly_reset}}

Already a member? Sign in here

Subscribe to Skift Pro to get unlimited access to stories like these

Already a member? Sign in here