Skift Take

Fashion has in many ways been steps ahead of travel when it comes to Web design, online engagement and marketing prowess — but there is still so far to go for luxury brands in both industries.

Luxury fashion brands are facing a critical moment in their digital evolution and there are dozens of parallels to luxury travel brands’ own digital development.

The most pressing challenge — and opportunity — facing the luxury fashion industry today is the incredible influence that digital wields over its fastest growing demographic, according to digital research firm L2 which ranks the digital competence of 90 fashion brands in its latest report DIQ: Fashion.

Millennials’ purchase power is growing within the luxury space. Buyers aged 20-36 are expected to grow from a quarter of the total luxury market to almost half by 2025, according to recent Bain statistics.

Millennials rely almost primarily on online channels for product discovery and interaction, making brand’s websites and social profiles the storefront for this critical demographic.

Luxury fashion brands traditionally brought their intrinsic values — top-level customer service, personalization, and quality — to life during the offline shopping experience, but this hasn’t translated to the experience online, shows the report.

Seventy percent of luxury fashion purchases are influenced by online interactions, according to the L2 report, and that number will rise as more millennials enter the luxury marketplace. E-commerce’s share of total luxury sales has doubled to eight percent since 2014 and will of course accelerate in the years to come.

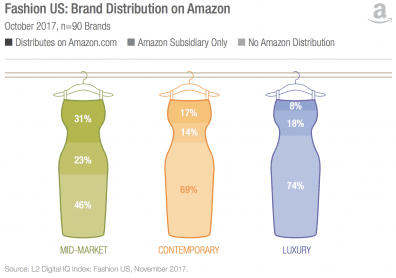

There are parallels, for example, between the distribution challenges that luxury hotels face with online travel agents and those that luxury fashion brands contend with from online resale sites such as The RealReal and retail giants such as Amazon.

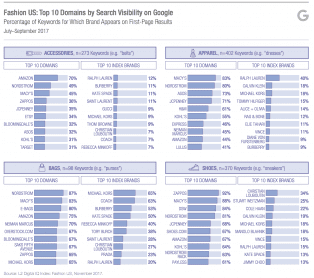

Luxury brands perform well in branded search results on Google, but fail to appear in most unbranded searches such “dresses,” “belts,” or “heels.”

Only a third of luxury brands in L2’s report appear in first-page organic results thus many brands, almost 90 percent, invest in paid category search in the U.S. — a significant increase over last year.

It is the largest retailers such as as Amazon and Nordstrom that consistently grab first-page visibility across all product categories. Although Amazon is traditionally considered a mass-market marketplace, its collaborations with emerging designers hint at its upscale target.

Traditional luxury brands have largely remained off Amazon. Only 17 percent of researched brands partner with Amazon, however, 69 percent of “masstige” brands — referring to mass-produced, relatively inexpensive goods which are marketed as luxurious or prestigious — have listed on Amazon. This highlights the mass appeal of digital marketplaces.

We’ve previously covered the consolidation of luxury fashion market — including Coach’s acquisition of Kate Spade and JAB Holding Co.’s sale of Jimmy Choo and Bally — in search of lessons for the luxury travel market.

The standout example is Marriott’s acquisition of Starwood and its expanded portfolio of luxury brands, but more niche luxury segments such as U.S. ski resorts and alternative housing platforms are also undergoing massive consolidation. Many marketers are faced with the task of differentiating and elevating the individual brands’digital mastery within these new frameworks.

(Marriott kept all of Starwood’s and its own luxury brands and Vail and Aspen maintain the names of all resorts they buy, but Accor combined its rental brands under the Onefinestay name.)

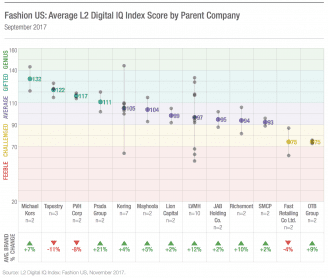

The L2 report examines the digital IQ of three luxury fashion conglomerates with 3+ brands.

LVMH ranks the lowest among the fashion giants although it’s making strides.

Seventy percent of LVMH Index brands have seen double-digit increases in Digital IQ,

with four — Fendi, Givenchy, Loewe, and Loro Piana — seeing over 20 point increases. LVMH tightened the gap between its best and worst performers by almost 10 points.

Kering’s digital know-how on the other hand is driven largely by Gucci — which is ranked #1 on L2’s list — suggesting that a rising tide raises all ships. Parent companies must identify the brands that are doing exceptionally well and apply those lessons to its other brands while maintaining their distinct features.

The Skift team last year took it upon itself to explain every one of Marriott’s and Hilton’s brands highlighting how tricky brand distinction can become in a corporation.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: Digital Marketing, fashion, luxury

Photo credit: Gucci ranks #1 on L2's digital IQ list for its superior digital experience across web, social, e-commerce and marketing. Gucci / Instagram